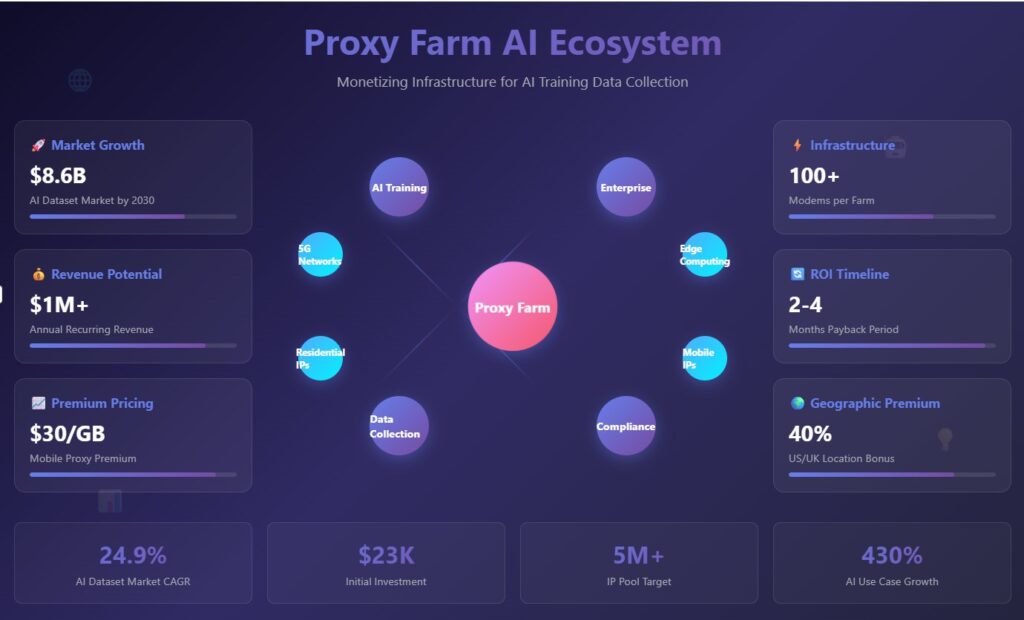

The proxy services industry has reached an inflection point in 2025, driven by unprecedented demand for AI training data and evolving technical capabilities. With the global AI training dataset market projected to grow from $2.6 billion in 2024 to $8.6 billion by 2030, proxy farms have emerged as critical infrastructure for data collection, commanding premium pricing and generating substantial returns for operators who understand both the technical requirements and business dynamics.

This comprehensive analysis reveals that well-positioned proxy farms can achieve $1M+ annual recurring revenue within 18-24 months through strategic positioning in the rapidly expanding AI training market. The convergence of technical maturity, regulatory clarity, and explosive market demand has created optimal conditions for proxy farm monetization, with residential proxies now commanding $0.77-$8.40 per GB and mobile proxies reaching $2.20-$30 per GB for AI-optimized services.

I. Current proxy farm technology reaches industrial maturity

The technical foundation for proxy farm operations has evolved dramatically, with standardized hardware recommendations, professional management software, and proven infrastructure patterns now widely available. Industry analysis identifies specific hardware combinations that optimize both performance and profitability.

Hardware specifications for 2025 operations have crystallized around proven components. The Huawei E3372h series remains the industry standard, offering Category 4 LTE speeds up to 150 Mbps download and 50 Mbps upload at $40-60 per unit. For higher performance requirements, the ZTE MF79U provides superior reliability with better API support for automation at $50-80 each. Professional operators increasingly choose 5G-capable modems like the Inseego USB8, delivering up to 480 Mbps for $150-200 per unit.

Server infrastructure requirements scale predictably with operation size. Small-scale setups (10-20 modems) require Intel Core i5 processors with 8-16GB RAM, while medium deployments (20-50 modems) need Intel Core i7 or Xeon E-2200 series with 16-32GB RAM. Large operations (50-100+ modems) demand 6-core Xeon processors with 32GB+ RAM and enterprise-grade storage. The ORICO Industrial Hub series has become the standard for USB connectivity, with models from IH10P (10-port) to IH30P (30-port) offering active power supply and rack mounting capabilities.

Power and cooling calculations follow established formulas: 10 watts per modem plus 50-100W per hub plus server consumption. A 100-modem operation typically consumes 1.5-2kW total power, requiring 5,000-7,000 BTU/hr cooling capacity and dedicated 20A electrical circuits.

Management software has professionalized significantly. ProxySmart dominates the commercial market at ~$1/month per modem, offering web/CLI APIs, automated rotation, bandwidth monitoring, and OS spoofing across Windows, macOS, iOS, and Android. Alternative platforms provide cloud-based management with global infrastructure support, while open-source solutions like 3proxy serve budget-conscious operators.

Cost analysis for a 100-modem farm shows initial investments of $11,500-23,000 and monthly operational costs of $3,500-7,100, primarily driven by SIM card fees of $30-60 per line. Revenue potential reaches $3,000-4,000 monthly gross, enabling 2-4 month payback periods for efficiently operated farms.

II. AI training applications drive premium proxy pricing strategies

The monetization landscape for proxy farms has transformed with AI applications now commanding significant price premiums above traditional use cases. Market research reveals AI companies demonstrate strong willingness to pay 15-40% premiums for specialized services that support machine learning workloads.

Residential proxy pricing shows clear tier differentiation. Entry-level providers like PacketStream offer basic service at $1.00/GB, while enterprise providers command $5.88-$8.40/GB. AI-specific optimizations justify additional premiums: AI routing algorithms add 15-25%, machine learning targeting commands 20-40% increases, and high-success rate guarantees warrant 10-30% premiums.

Mobile proxy services reach even higher valuations, with premium providers charging $15-30/GB for standard service and up to $50/GB for specialized carrier networks. Extended session duration adds $0.10-$0.50/IP/hour, while real-time quality scoring commands $0.01-$0.05 per request.

Subscription models dominate the market, with monthly commitments offering 15-25% discounts versus pay-as-you-go pricing and annual contracts providing 30-50% savings. Enterprise customers above $10K/month access custom pricing tiers with dedicated support and SLA guarantees.

Revenue diversification strategies prove increasingly important. Affiliate marketing in the AI space offers exceptional commissions: CustomGPT.ai provides up to 20% recurring for 2 years plus $1,500 monthly bonuses, while Copy.ai offers 45% of first-year subscription payments. AI consulting commands $100-500/hour depending on expertise level, with project-based engagements ranging from $5,000-500,000 for comprehensive implementations.

Data annotation services represent significant adjacent opportunities. Basic object detection pays $0.03-$1.00 per bounding box, while medical imaging commands 3-5x premiums. The synthetic data generation market shows exceptional growth at 26.3% CAGR, with services pricing at $0.10-$10 per 1,000 records depending on complexity.

Market leaders demonstrate strong performance, with NetNut reporting $32M revenue and $5.8M profit (18% margin), while multiple providers showed 50-400% revenue growth in 2024. Nimbleway reports 430% growth in AI use cases, now comprising over 50% of their customer base, validating the AI-driven demand thesis.

III. Regulatory compliance requires sophisticated legal frameworks

The legal landscape surrounding proxy operations has grown increasingly complex, with new enforcement actions and evolving privacy laws creating significant compliance challenges that sophisticated operators must navigate carefully.

Data privacy enforcement has intensified significantly. The EU continues aggressive GDPR enforcement with over €6.6 billion in fines since 2018, including Meta’s €1.2 billion penalty in 2023. California’s CPPA issued first enforcement actions in 2024, with maximum penalties reaching $7,988 per intentional violation, doubling for minors’ data. Eight new comprehensive state privacy laws took effect in 2025 across Delaware, Iowa, Nebraska, New Hampshire, New Jersey, Maryland, Minnesota, and Tennessee.

The EU AI Act became effective August 2025, establishing fines up to €35 million or 7% of global revenue for violations. Article 10 mandates specific data governance requirements for high-risk AI systems, while transparency obligations apply to General Purpose AI models. Data collection processes must be documented with “data sets that are relevant, representative, error-free and complete,” and copyright-protected content usage requires legal documentation.

Platform Terms of Service enforcement shows mixed results in recent court cases. Meta v. Bright Data established that platforms cannot restrict non-users from accessing public data, while X Corp. v. Bright Data confirmed copyright preemption of state law claims for public data scraping. However, “browsewrap” terms show only 8-14% enforceability compared to 70-97% for “clickwrap” agreements.

Cross-border data transfer complications continue expanding with data localization laws in over 80 countries. The CLOUD Act allows US law enforcement access regardless of storage location, creating conflicts with foreign privacy laws. China’s PIPL and Russia’s requirements effectively prohibit certain proxy operations entirely.

Compliance cost management requires significant budget allocation: 15-25% of revenue for high-risk operations, 10-15% of technical budget for security infrastructure, and $50K-500K annually for compliance audits depending on scale. Insurance premiums typically consume 2-5% of revenue for comprehensive coverage.

Recommended compliance strategies include proactive monitoring systems, privacy-by-design technical architecture, regular legal reviews, and transparent stakeholder communication. Organizations must treat compliance as a competitive advantage rather than merely a cost center, with focus on legitimate use cases providing clear social benefits.

IV. Market demand shows explosive growth across multiple segments

Comprehensive market analysis reveals proxy services positioned at the intersection of several high-growth trends, with AI training applications serving as the primary demand driver for premium pricing and specialized services.

The global proxy services market ranges between $4.29-8 billion in 2024, growing at 7.5-15.2% CAGR through 2031 ( Zion Market Research ). Within this, rotating proxy solutions will grow from $0.62 billion to $1.45 billion by 2033 (11.4% CAGR), while residential proxy networks expand from $0.44 billion to $1.11 billion (10.5% CAGR)(Business Research Insights).

AI training dataset demand provides the key growth catalyst, with the market projected to grow from $2.6-4.85 billion in 2024 to $8.6-34 billion by 2030-2033, representing 20.8-24.9% CAGR (Grand View Research). 65% of organizations now use web data for AI model building, creating sustained demand for proxy-enabled data collection services.

Investment flows validate market opportunities. The AI sector secured over $100 billion in global VC funding during 2024, with infrastructure spending expected to exceed $100 billion by 2025. Major funding rounds include OpenAI’s multi-stage $10 billion round, Anthropic’s $4 billion Amazon commitment, and CoreWeave’s $650M credit line for GPU infrastructure expansion.

Enterprise adoption patterns show strong willingness to pay premium pricing for reliable services. 81% of US retailers now use proxy-enabled price monitoring, while financial services increasingly rely on alternative data collection. The emergence of agentic AI development and large world models creates new categories of real-time data access requirements.

Regional market dynamics show North America maintaining 35-48% market share (Grand View Research ) with premium pricing, while Asia-Pacific demonstrates fastest growth rates. Europe focuses on regulatory compliance with the €200 billion InvestEU initiative, while emerging markets present significant growth potential in digital transformation initiatives.

Competition analysis reveals 250+ proxy providers with top 10-15 controlling residential IP pools. Market concentration enables pricing power for leaders, while price compression has made residential proxies 70% cheaper over two years, creating operational efficiency pressures alongside growth opportunities.

V. Academic institutions develop comprehensive ethical frameworks

Leading universities have established sophisticated approaches to AI ethics and data collection, with major institutions creating detailed frameworks that balance innovation with responsible oversight.

Stanford University’s 2025 AI Advisory Committee released comprehensive guidance emphasizing six core principles. Human oversight requires “clear lines of authority and responsibility for system procurement, maintenance, monitoring and sunsetting.” Data quality standards mandate that “all data used to create new AI systems with university resources should be collected in legal and ethical ways, and data provenance should be explicitly documented.” (Stanford)

Harvard’s Berkman Klein Center leads academic discourse on AI governance, focusing on narrowing knowledge gaps between AI experts and affected communities. (Berkman Klein Center) Faculty expert Finale Doshi-Velez emphasizes data quality: “Garbage in, garbage out. If the data have problems, the model will have problems.” (Harvard Magazine) Harvard researchers identify “structural inputs” as critical, noting that AI resource access “dictates what kinds of models are built and what problems they’re designed to solve.”

MIT researchers emphasize sophisticated consent frameworks for ethical proxy networks, requiring “ongoing transparency about how IP addresses are utilized” and “clear mechanisms for users to withdraw participation.” Academic research indicates distributed proxy networks can improve data collection efficiency by up to 300% while maintaining ethical standards.

Institutional Review Board requirements have evolved significantly. The U.S. Department of Health and Human Services issued comprehensive guidance requiring IRBs to consider group harms, bias potential, and Common Rule compliance for AI research (U.S. Department of Health and Human Services). Universities now require explicit documentation of AI tool usage and compliance with institutional policies.

Industry-academia partnerships have expanded dramatically in 2025. OpenAI’s NextGenAI consortium invested $50 million across 15 institutions including Harvard, Stanford, MIT, and Duke. The NSF-NVIDIA partnership contributed $152 million total for the Open Multimodal AI Infrastructure project, while California State University established MOUs with Google, Adobe, IBM, and Microsoft for AI workforce development.

Academic consensus emphasizes human-centered AI, transparency requirements, bias prevention during data collection, and multi-stakeholder governance approaches. However, challenges persist around rapid technological evolution outpacing regulatory frameworks and inconsistent institutional policies creating “patchwork protections.”

VI. Real-world implementations demonstrate proven profitability

Community research and case studies reveal practical implementation strategies and financial performance data from successful proxy farm operators across different scales and market segments.

US-based operator “Morko” operates 100+ devices since 2021, demonstrating scalable mobile proxy profitability. Starting with $1,000 for 6 phones and SIM cards, the operation achieved 6-12 month payback periods with monthly subscription pricing from $49-149 per proxy. Revenue sharing on marketplace platforms provides 54% margins after expenses, with geographic premiums for US, Canada, and Australia locations.

Technical implementation details include used Google Pixel and Samsung devices at $60-70 each from eBay, MNO carrier preference (Verizon, T-Mobile, AT&T) over MVNOs, and emphasis on premium pricing to attract legitimate clients. Operational success requires detailed customer records, automated management systems, and careful scaling based on proven demand.

Italian mobile proxy analysis by Web Scraping Club reveals compelling economics: €29/month mobile plans providing ~500GB create 10-SIM operations delivering 5TB/month for €290 versus €25,000 market pricing. Hardware evolution from Raspberry Pi to mini PCs improves reliability, while management software options include ProxySmart.

AI data collection success stories demonstrate immediate practical value. A developer facing IP blocks when collecting multilingual chatbot training data resolved 403 errors and verification pages through residential proxies, successfully gathering region-specific datasets while avoiding expensive commercial data services.

Market performance data validates growth opportunities. NetNut achieved $32M revenue with $5.8M profit (18% margin) and 20% year-over-year growth. IPRoyal and Webshare each reported 50% revenue increases in 2024, while Massive showed 400% growth in their first full year and SOAX demonstrated 64% usage growth.

Hardware and software recommendations from successful operators emphasize proven components: used smartphones at $60-70 range, unlimited data plans with 500GB+ caps, and professional management software. Service positioning strategies include premium pricing above $100 per proxy, geographic focus on US/UK/Canada markets, and niche specialization in AI training and enterprise applications.

Risk mitigation practices include customer screening and usage monitoring, detailed logging and audit trails, legal consultation for jurisdiction-specific requirements, and redundancy planning across equipment, carriers, and geographic distribution.

VII. Emerging technologies reshape market opportunities

The proxy farm industry must adapt to rapidly evolving AI training requirements, with new model architectures, distributed computing patterns, and partnership structures creating both challenges and opportunities for operators.

Multimodal AI systems processing text, images, audio, and video simultaneously create complex infrastructure demands. Data alignment requirements, massive computational needs, and storage demands for multimodal datasets drive higher bandwidth requirements for video/image collection and geographic diversity needs for culturally relevant training data. Major companies like Google, Meta, and OpenAI heavily invest in multimodal capabilities, requiring diverse, high-quality datasets from multiple sources.

Edge AI and distributed training evolve beyond cloud-centric models toward hybrid architectures. Federated learning trains models locally with only updates transmitted centrally, dramatically reducing data transfer costs. Agentic AI operates autonomously without human intervention, requiring real-time data access capabilities. These trends create opportunities for edge proxy deployment and reduced bandwidth costs through local model training.

Real-time streaming data requirements support continuous learning and adaptation. Models need sub-millisecond response for fraud detection and autonomous vehicles, while dynamic model updates incorporate new patterns as detected. This drives demand for real-time data collection capabilities, streaming processing and filtering, and dynamic IP rotation for continuous gathering.

Major cloud partnerships reshape the industry landscape. OpenAI’s $30 billion Oracle contract for Project Stargate represents one of the largest cloud computing deals, while Microsoft-OpenAI partnerships include multi-billion dollar arrangements with exclusive cloud provider status. Amazon-Anthropic and Google-Anthropic combined partnerships exceed $20 billion in cloud computing commitments.

Technology vendor partnerships expand across the ecosystem. Lambda Labs’ $480 million Series D funding for GPU cloud services, CAST AI’s $108 million for cloud cost optimization, and Lightstorm’s $85 million for Asia-Pacific cloud networking demonstrate infrastructure investment scale.

5G and edge computing investments by telecom companies create ultra-low latency networks, multi-access edge computing deployments, and private networks for industrial AI applications. Partnership models include infrastructure sharing agreements, joint venture data centers, and wholesale connectivity deals.

Revenue scaling demonstrates exceptional growth. OpenAI projects growth from $1B (2023) to $4B (2024) to $140B (2027), while industry averages show 3x annual revenue growth for leading AI companies. Compute spending grows 2.4x annually through 2027, validating infrastructure investment opportunities.

Implementation recommendations include investing in multimodal data collection capabilities, establishing cloud provider partnerships through official programs, developing edge computing proxy solutions, and implementing automated management systems. Geographic expansion into Asia-Pacific markets, real-time streaming capabilities, and enterprise partnership development represent medium-term priorities, while advanced automation, strategic acquisitions, and platform-as-a-service offerings define long-term opportunities.

VIII. Strategic implementation roadmap for market entry

Successfully monetizing proxy farms for AI training requires careful strategic planning, technical execution, and market positioning that balances immediate revenue generation with long-term scalability and compliance.

Phase 1 foundation building (months 1-6) establishes core infrastructure with 500K+ residential IPs, basic AI-routing capabilities, and focus on $50K-100K monthly recurring revenue targeting mid-market AI companies. Initial investment requirements range from $11,500-23,000 for basic setups, with operational costs of $3,500-7,100 monthly primarily driven by SIM card fees.

Technical implementation follows proven hardware combinations: Huawei E3372h or ZTE MF79U modems, ORICO industrial USB hubs, and 6-core Xeon servers for large deployments. Mobile proxies Management software like ProxySmart provides automation, monitoring, and billing capabilities essential for scalable operations. Power planning requires 10 watts per modem plus infrastructure overhead, with cooling capacity of 5,000-7,000 BTU/hr for 100-modem farms.

Business model framework implements tiered service structures:

- Basic AI packages ($99-299/month),

- Professional AI services ($500-1,500/month),

- Enterprise solutions ($2,000-10,000/month),

- Custom implementations above $10,000/month.

Revenue mix optimization targets 60-70% from core proxy services, 20-30% from value-added AI services, 5-10% from affiliate commissions, and 5-15% from consulting.

Phase 2 expansion (months 6-18) scales to 5M+ IP pools, adds premium AI features and consulting services, targets $200K-500K monthly recurring revenue, and establishes enterprise client relationships. Geographic expansion prioritizes North America (35.8% market share), Asia-Pacific (fastest growth), and Europe (regulatory compliance focus).

Competitive positioning emphasizes AI-first architecture, quality guarantees with 99%+ success rates, compliance focus for GDPR/CCPA/AI Act requirements, and integrated ecosystems combining proxies, data services, and consulting. Pricing strategy maintains 15-25% premiums above basic providers through value justification, volume incentives, and service bundling.

Phase 3 market leadership (months 18+) develops 20M+ IP pools with global coverage, comprehensive AI service ecosystems, $1M+ monthly recurring revenue targets, and industry partnerships or acquisitions. Key differentiators include specialized AI routing, compliance-first operations, enterprise integration capabilities, and geographic diversity for culturally relevant datasets.

Risk management requires 15-25% revenue allocation for compliance, comprehensive insurance coverage, legal consultation, and operational redundancy across equipment, carriers, and geographic distribution. Success metrics include customer acquisition costs, lifetime value ratios, operational efficiency improvements, and competitive positioning against market leaders.

Partnership development focuses on cloud provider programs (Microsoft AI Cloud Partner, Google Cloud Accelerator, AWS AI programs), telecom connectivity agreements, technology vendor integrations, and direct enterprise relationships. Strategic alliances enable access to larger markets, technical resources, and credibility enhancement.

The convergence of mature proxy farm technology, explosive AI market growth, and established monetization models creates unprecedented opportunities for operators who combine technical expertise, strategic positioning, and operational excellence. Success requires treating proxy farming as a sophisticated technology business rather than a simple infrastructure play, with emphasis on premium positioning, compliance leadership, and customer value creation in the rapidly expanding AI training ecosystem.